Brand new Dos and you may You should nevers of getting an exclusive Mortgage Pre-Acceptance

The fresh new housing sector is actually enduring when you look at the Ontario having both unprecedented property conversion and you will increases about mediocre household rates on GTA and somewhere else on the Province. Despite the ongoing Covid-19 Pandemic, Ontario residents was watching a flourishing market.

Depending on the Ontario Home Association, home-based conversion process craft stated through the Multiple listing service (MLS) inside the Ontario designated thirteen, 885 tools inside the January from the 12 months hence stands for a rise of 31.5% when compared with household conversion the same time last year. This is short for another type of conversion process number to possess January on the State. The average price of selling residential property sold in Ontario during are accurate documentation $ 796,884 ascending twenty six.7% regarding .

To benefit regarding including a bona fide home upswing from inside the Ontario an effective mortgage pre-recognition can depict a beneficial step into the qualifying to have a great financial. When you shop around for home financing it could be advisable to glance at the procedure for pre-recognition to help provide a sense of just how much you could potentially possibly manage and you will what sort of mortgage you will likely meet the requirements to own.

Just what Not to ever Carry out After Becoming Pre-Accepted to have a home loan?

Although it is best to attempt to enjoys a price off what you can feel pre-recognized having when it comes to obtaining a mortgage, you’ll find things that you shouldn’t carry out about the pre-recognition process.

- Immediately following becoming pre-acknowledged, dont sign up for subsequent borrowing from the bank Just after bringing wide variety one mirror your finances its very important to perhaps not put people brand new prospective expenses. Obtaining credit cards, instance, can potentially increase your debt burden if you aren’t ready to invest in full.

- Usually do not thinking about cost management in the high prevent of your own budget- economic affairs changes thus allow for some step room in your financial allowance whenever plugging from the number.

- End and also make one huge instructions- never put things in the complete budget that may alter the numbers for any sitting yourself down with a lender. The brand new amounts is stand a similar.

- Do not make any alter into the employment standing prevent stopping your current reputation or deciding on most other services you to could have a beneficial probationary several months. The wide variety should sit the same hence has paycheck data which you given regarding pre-approval process

Do pre-approvals hurt your credit score?

It is important to keep in mind that a beneficial pre-acceptance is largely an offer with what you can be considered to possess in an interest rate. A loan provider won’t be extract your own credit in the pre-approval procedure thus, pre-recognition doesn’t apply at your credit score. When it comes time to stay which have a lender and you can discuss new regards to an interest rate, your borrowing would-be taken regarding either Equifax or Transunion.

Exactly what should you payday loans online Kentucky decide create before you apply having home financing?

- Discover your credit score and try to boost your credit score ahead of trying to pre-acceptance.

- Gather all the documents required and additionally proof money, financing comments, and you can proof property.

- Look a pre-recognition costs.

- Be in contact which have an agent getting recommendations.

Can you feel pre-accepted for a home loan and stay denied?

The short answer is yes. Mortgage pre-acceptance lies in certain conditions. Minimum conditions are necessary to be eligible for an interest rate out of a bank otherwise borrowing connection. These lenders requires a great credit history, sufficiently shown earnings, and you will a reduced debt proportion versus present assets.

Private lenders can be found in the right position, not, to help you pre-agree property owners having a guaranteed home mortgage despite borrowing points or other types of wages along with mind-working earnings. Though there will be proof monthly income and you may any extra assets that prove beneficial, getting denied an exclusive loan try not as likely than other designs out-of lenders.

Ought i pay Credit card debt before applying for a great mortgage?

Whatever personal debt that requires ongoing monthly obligations are paid back as quickly as possible. In so doing, you are reducing your complete house loans proportion that may increase the chances of qualifying for the best words to own an excellent real estate loan.

This is especially valid to have credit card debt. Of all of the house loans, credit card debt shall be paid back earliest. Not just manage handmade cards constantly include high-rates of interest (some notes charge of up to 19% in order to 21% desire or maybe more as in happening of some shop credit cards) but personal credit card debt is considered bad personal debt on the eyes of every loan providers.

In the event that credit debt is at profile considered excessive by the loan providers, this could avoid of several lenders of pre-approving your for a mortgage. Private lenders can pre-accept your to own an interest rate, however, in the event that most other standards is actually found.

What Financial Price Must i Get Pre-Recognized To possess?

Mortgage costs will vary depending on the financial picture of for each applicant. The greater the money, the lower the household debt, the better the credit score, therefore the probability of most possessions will make sure a knowledgeable prices for the a pre-approved home loan.

Alternatively, busted credit, issue to show monthly income, decreased property so you can serve as extra guarantee is explanations so you can pre-accept getting an interest rate which have increased interest and highest overall fees regarding the pre-acknowledged mortgage. Individual lenders can pre-agree having such as for instance financing.

Interest rates with the really personal mortgages cover anything from eight% so you can 12% with respect to the novel economic products of your own applicant. Banks will be able to discuss all the way down rates of interest toward pre-acknowledged mortgage loans. New standards, but not, are stringent, and damaged borrowing from the bank commonly prevent a lender out of pre-granting an applicant.

Private lenders can pre-approve people which have broken borrowing from the bank and you can non-antique income when such candidates may have been rejected pre-recognition because of the a financial.

How exactly to Sign up for Personal Home loan Pre-Approval which have Large financial company Store

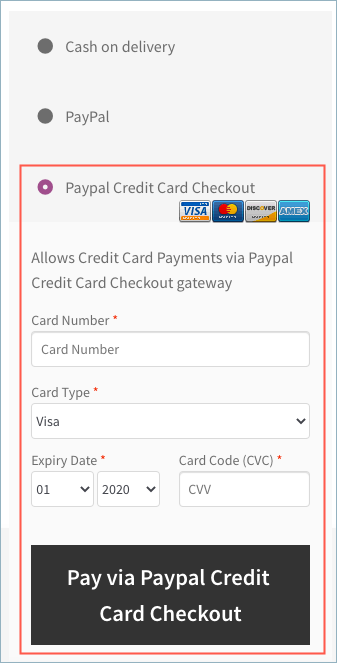

From the Large financial company Store we are able to enable you the Automatic Personal Home loan Pre-Acceptance Equipment. This product will enable you to determine what form of loans you can be eligible for which takes new thinking regarding the mortgage acceptance processes. Immediately after doing the application, an excellent PDF structure of your own pre-approval file is obtainable which is emailed for your requirements to have your own source.

There are various brand of mortgage loans that exist courtesy well-based private lenders. When your pre-acceptance unit reveals that you have not been approved, we could sit to you and try to negotiate terms towards a private mortgage loan looking at your whole financial image. Please call us at your convenience. I will be able to help you discuss financial resource so you can produce closer to your financial goals.